Let me know if you're having trouble accessing data on the Bountiful platform I'm here to help.

Keep reading for this week's latest or sign in to the Bountiful platform for your almond market data-driven indicators.

🔥 The hottest market in almonds: India

Two weeks since India lowered tariffs, is it helping drive demand?

September 6th is the effective date when India lowered tariffs on In Shell and Shelled almonds. The lower tariffs resulted in cost savings to Indian buyers, decreasing In Shell cost by about $0.16/lb, and Shelled cost by about $0.53/lb (source).

And since we've had about two weeks since the tariffs changed, and India is country number 1 that's driving early shipping demand. I wanted to take a look at how the tariff changes are impacting shipments.

Are we seeing an increase in Shelled almonds going to India? Or is In Shell still king 👑?

If you aren't using Weekly Exports, you should be, especially if you buy or sell almonds. It's a great way to uncover in real-time how the market is reacting to various changes (price, tariffs, etc.) + who's driving demand, well before the position report is released.

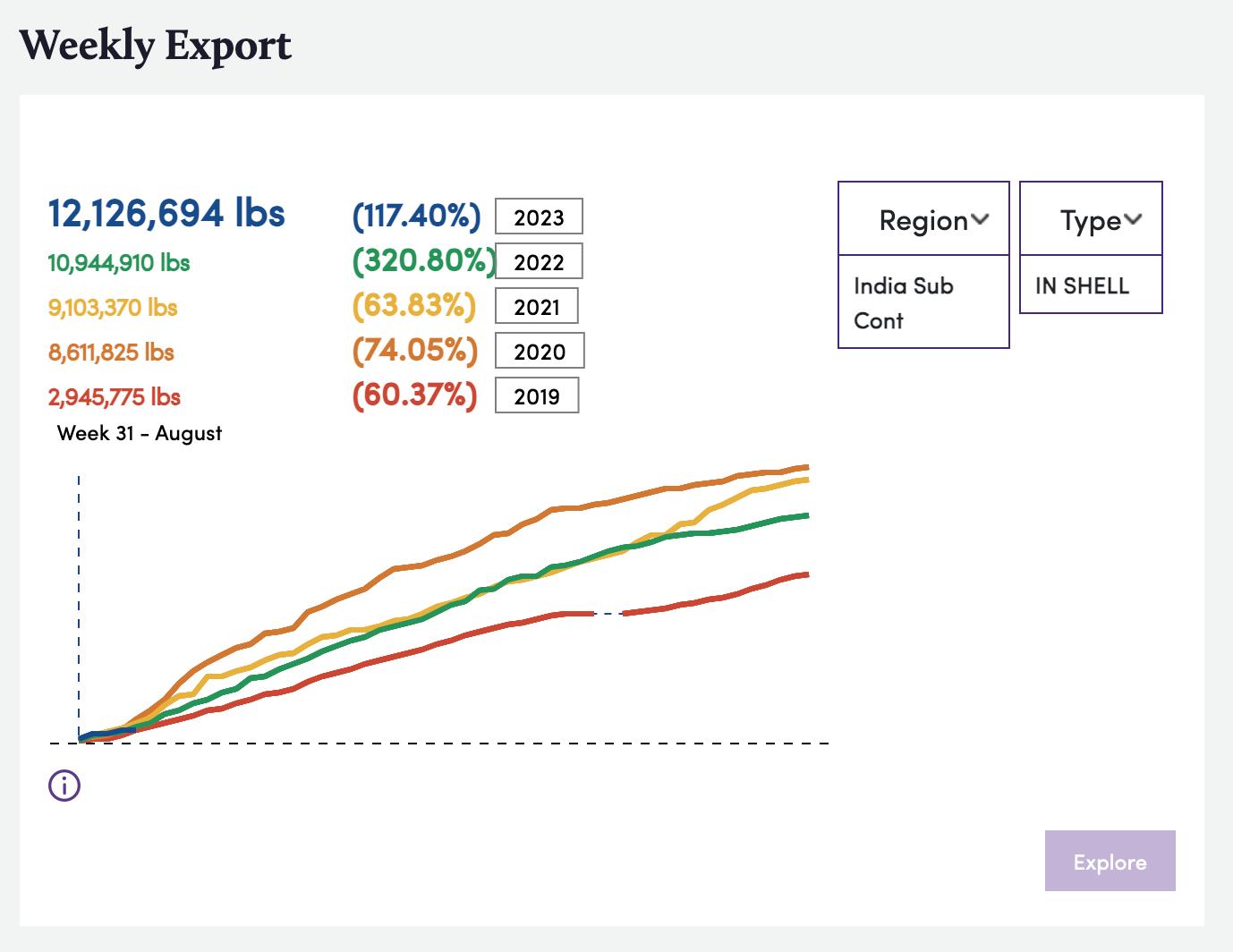

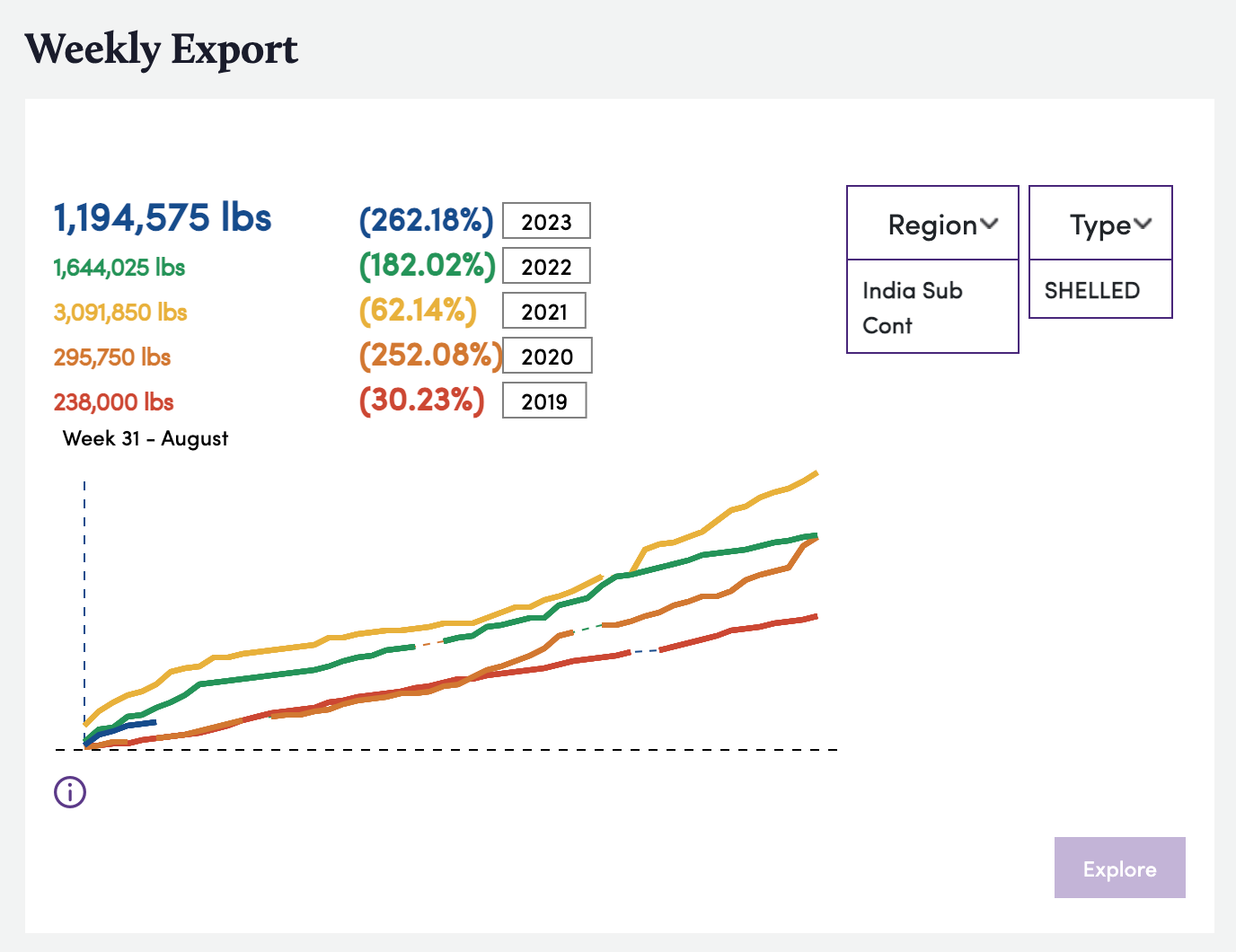

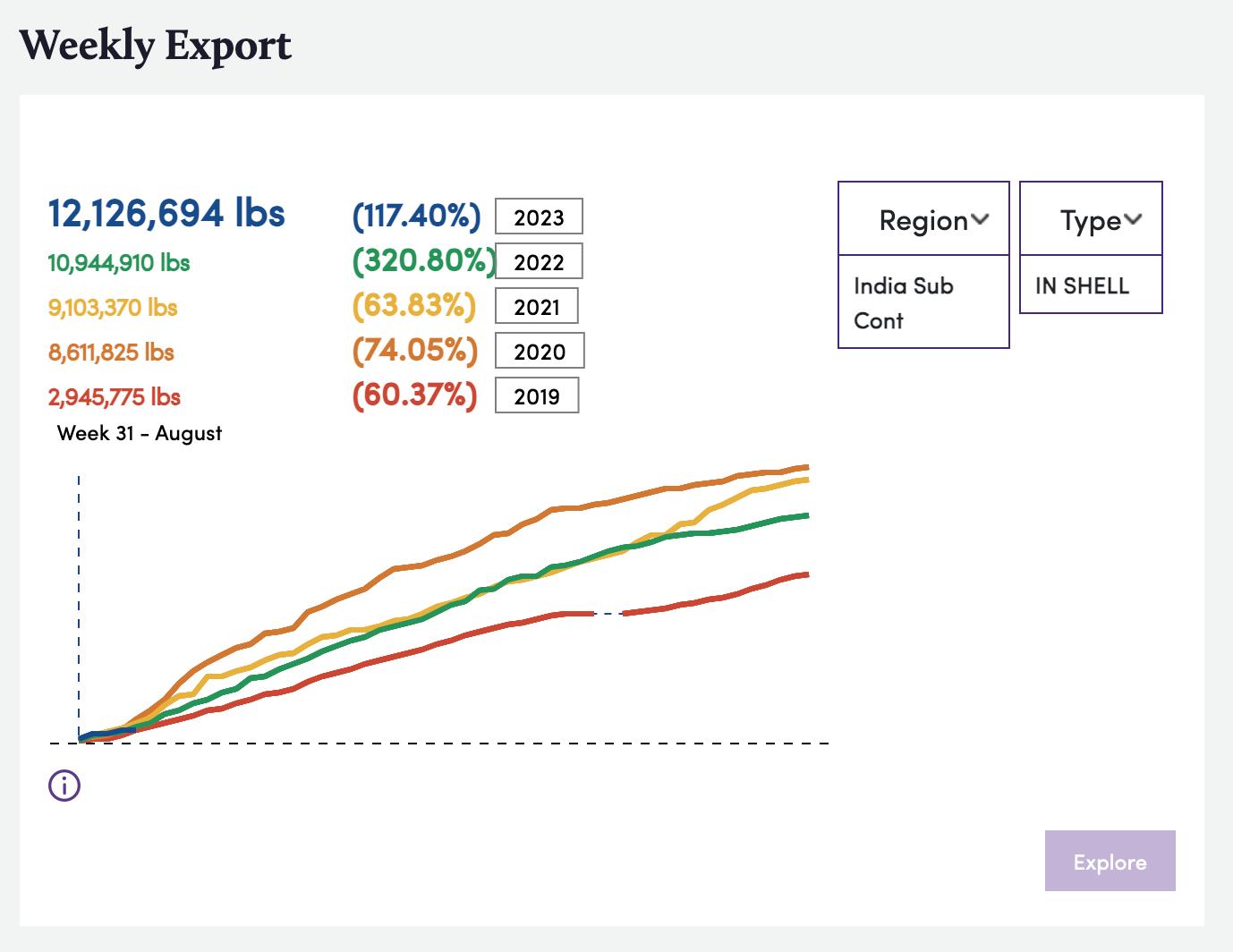

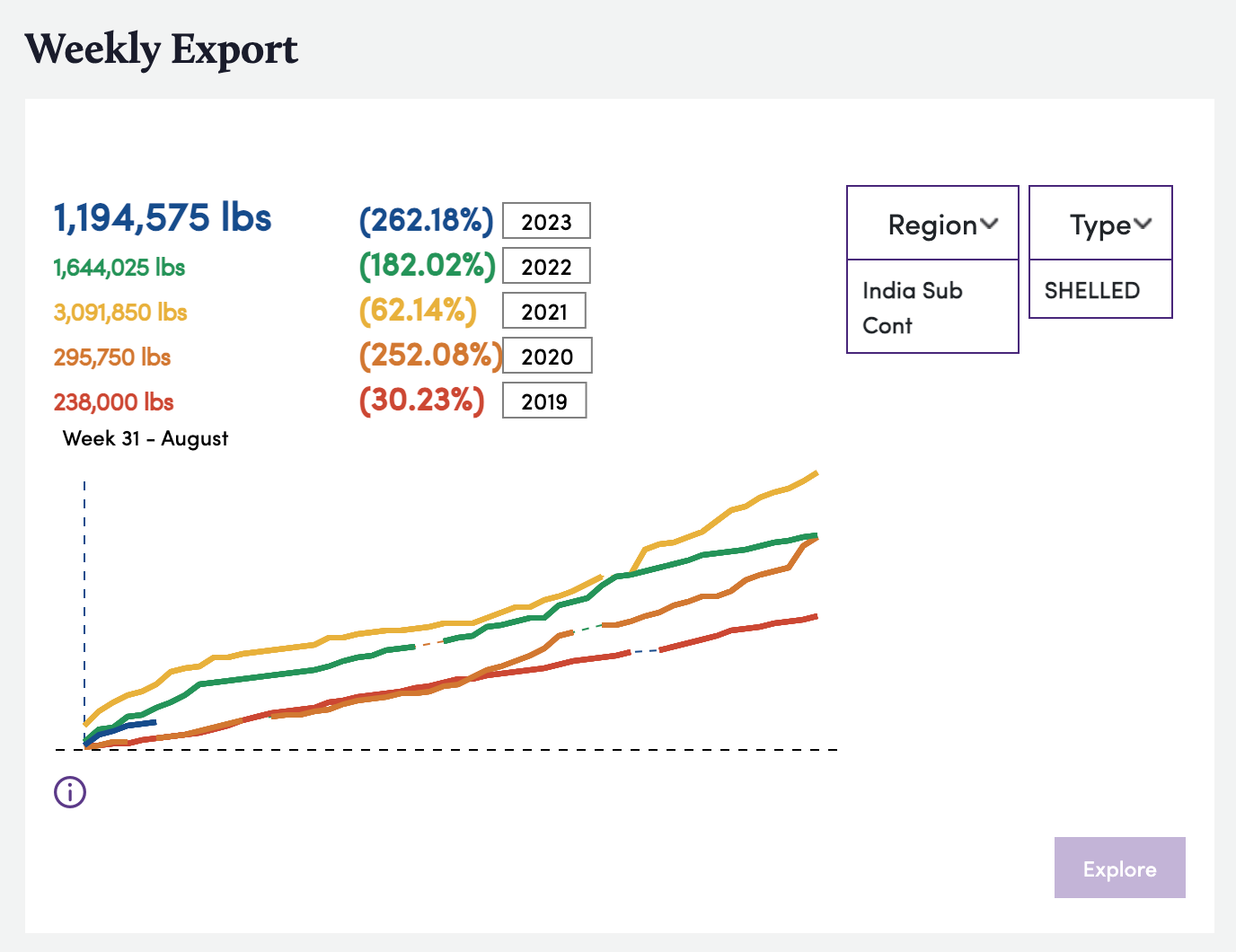

Two screenshots from Bountiful, Market 👇 for you, showing Weekly Exports: In Shell and Shelled shipments to India Sub Continent (includes India, Shri Lanka, Bangladesh, and Pakistan) at the start of the 2023 marketing year.

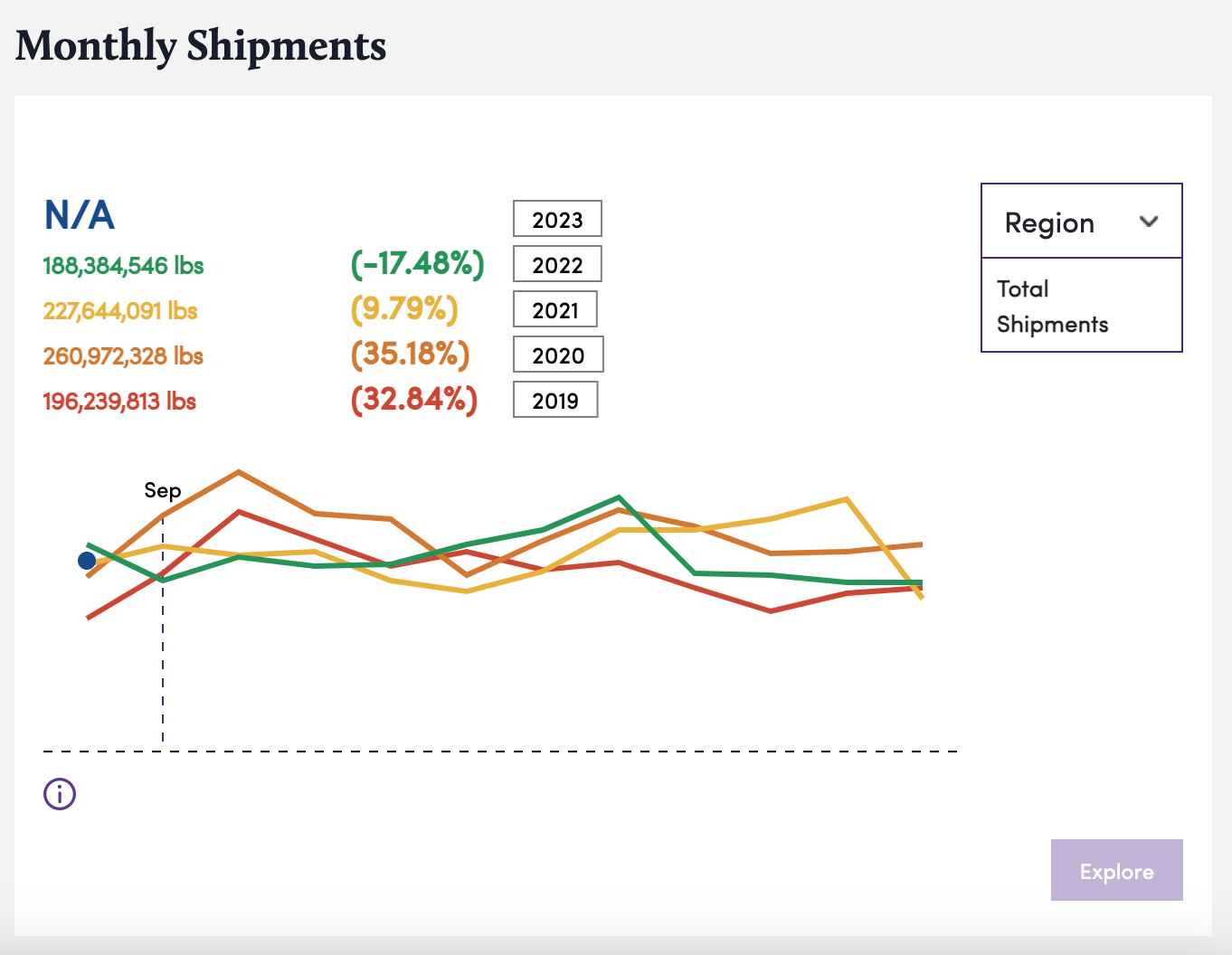

🚢 Weekly Exports, is the dataset I'm using today to learn whether the tariff changes India made earlier this month are shifting buying demand patterns in India. I've isolated shipments for India only and below I'm showing you India shipments for Weeks 36-37 (In Shell vs Shelled) for 2023 and 2022.

India Weekly Exports Weeks 36-37

- Sept 4-18, 2023

In Shell: 4,805,004 lbs

Shelled: 0 lbs

- Sept 4-18, 2022

In Shell: 12,068,570 lbs

Shelled: 250,650 lbs

As you can see above, changes in tariffs seem to have no effect yet on shipments and In Shell is still king 👑. Will this continue throughout the 2023 marketing year?

How does your own buy or sell data compare?

Buyers: Are you increasing shelled almond purchases for India?

Sellers: Are you seeing more interest for shelled almonds from India?

I'd love to hear from you and let me know if you'd like us to ask this question in Coffee Shop!

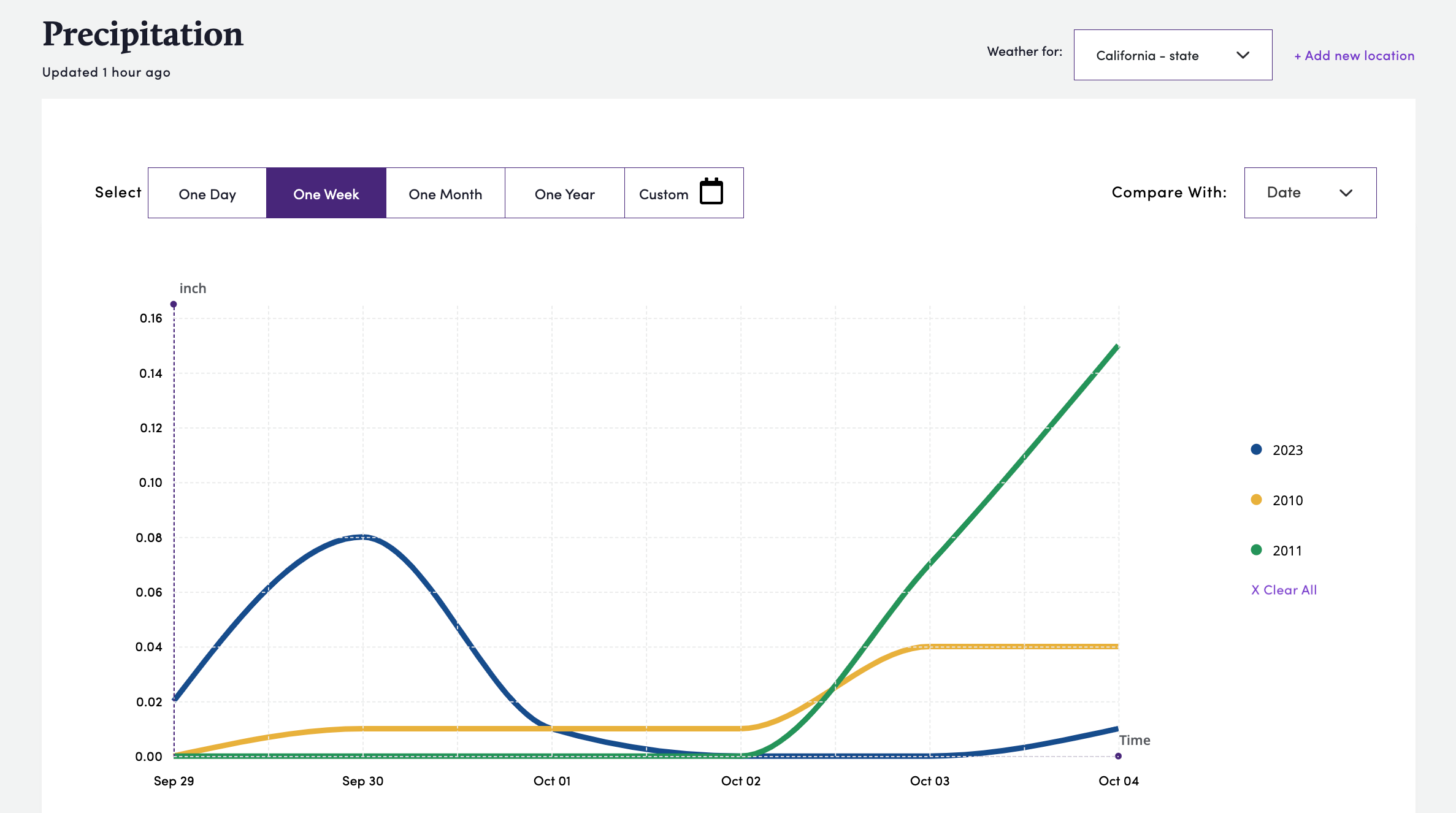

🌧️ El Niño Update

Are you ready for another wet winter?

NOAA's updated their forecasts for September. According to the September El Niño-Southern Oscillation Outlook, El Niño is expected to stick around (with greater than a 95% chance) at least through January-March 2024. There is now around a 71% chance that this event peaks as a strong El Niño this winter (Oceanic Niño Index ≥ 1.5 ˚Celsius)

While the 95% chance of El Nino stayed the same for September, the most recent update is a shift in the timing of El Niño. August's report was (December 2023 - February 2024).

What does El Niño mean?

Wetter conditions than normal for this winter. Depending on when the rain starts, there could be harvest impacts and ultimately decreased almond processing speed. Here is a great summary, from NOAA, on El Niño conditions.

You can keep up to date and prepare your farm operations at Bountiful Weather!

Subscribe to Weekly Almond Update for the latest almond market intelligence and industry news.