Weekly Almond Update: 9/28/23 to 10/4/23

Welcome to your Weekly Almond Update! My apologies for sending this a day late, I've been traveling in the South Valley + Central Coast this week for meetings and today I'm back.

📣 Before I dive in, a quick update for you. We’re changing things up on how we share information with you and the greater Bountiful community. We're testing some new things so expect some changes to our almond updates over the coming weeks and months. If you have suggestions for me, I'd love to hear from you.

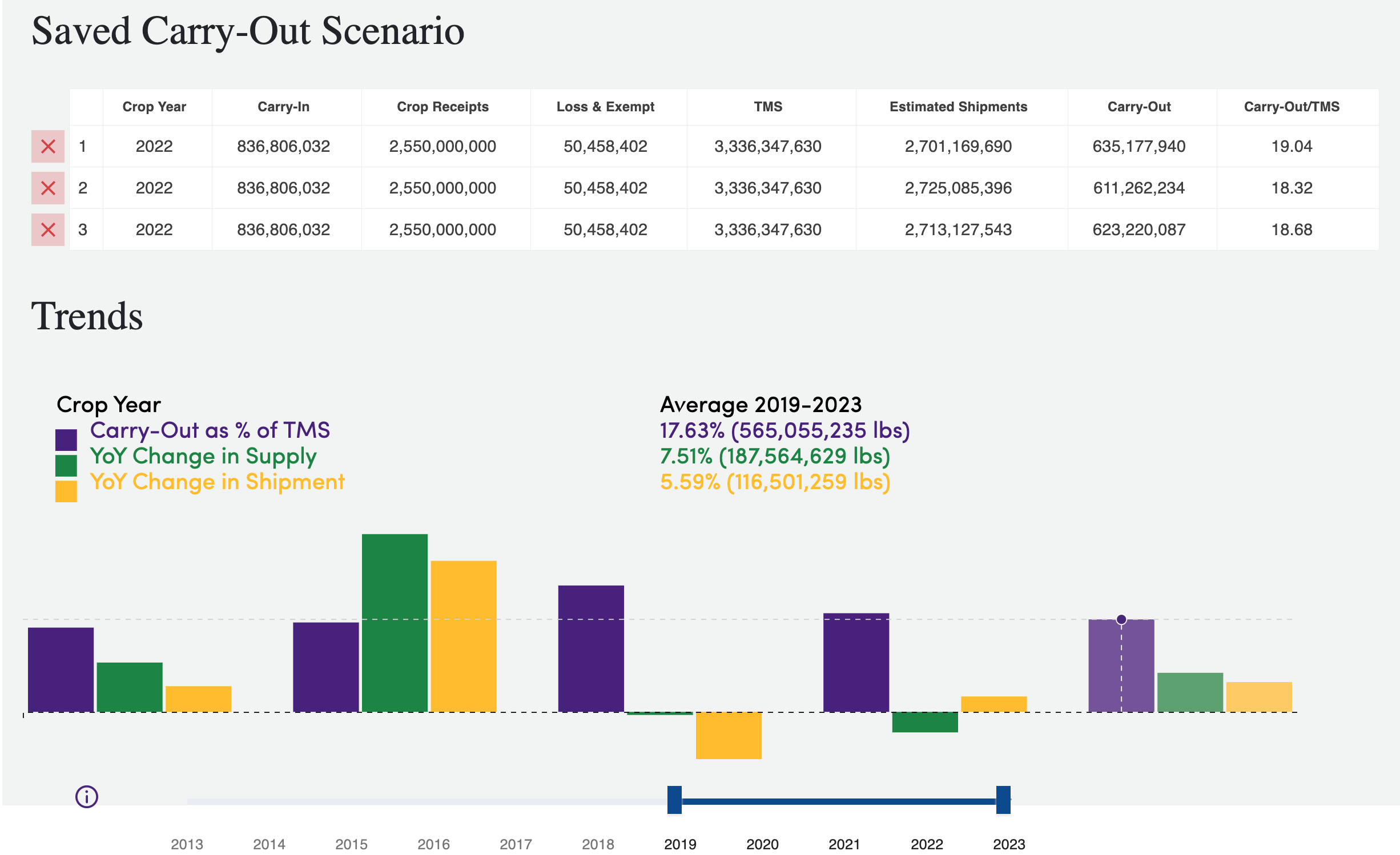

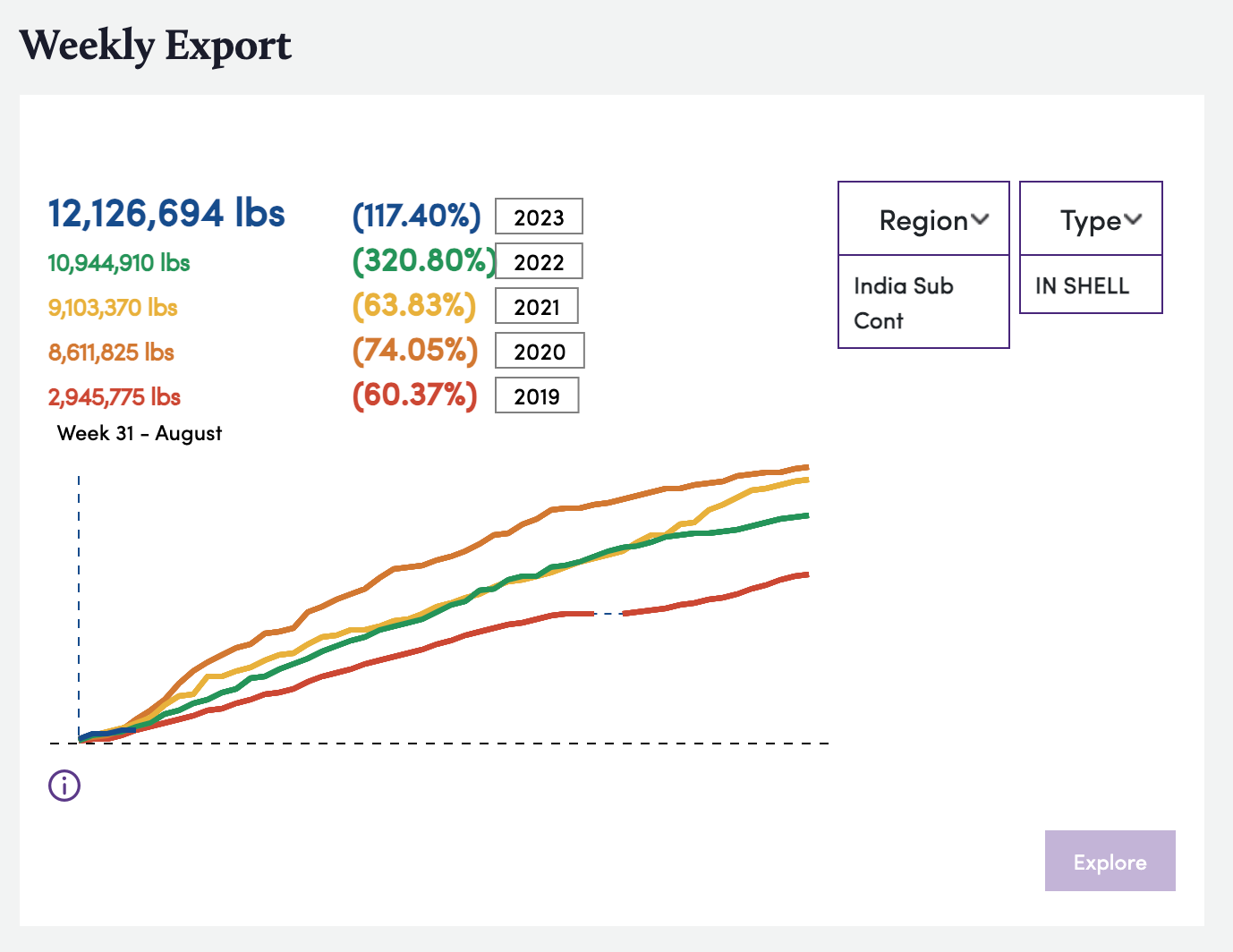

Starting today, we're renaming the Weekly Almond Market Update to Weekly Almond Updates. And below you'll notice we've removed Pricing, Weekly Export, and Carry-Out data, which is exclusive to Premium subscribers of the Bountiful platform.

🎉 If you'd like to upgrade to Premium, sign up here.

🤓 Want to learn more about our Premium subscription? set up a chat with me.

This week we're covering:

-

The rain came, let's talk impacts

- September's Almond Position Report, out next week

Keep reading for this week's latest or sign in to the Bountiful platform for your almond market data-driven indicators. Friendly reminder, the Bountiful platform is built to operate BEST on your 💻 computer browser.

🌧️ The Rain Came...

Remember last week's email, rain in the forecast? It delivered.

An unusual harvest... and well same for the growing season... unusual has been the norm for this year's almond production. If you recall last week, I shared an 88% chance of rain in the forecast. It came, now let's talk about what this means for crop receipts, more damage, and lessons learned from 2010/2011.

But before that, I want to pass on a tip from Luke Millerton @ UCANR how how to maintain quality of almonds after the rain.

Now back to rain during harvest.

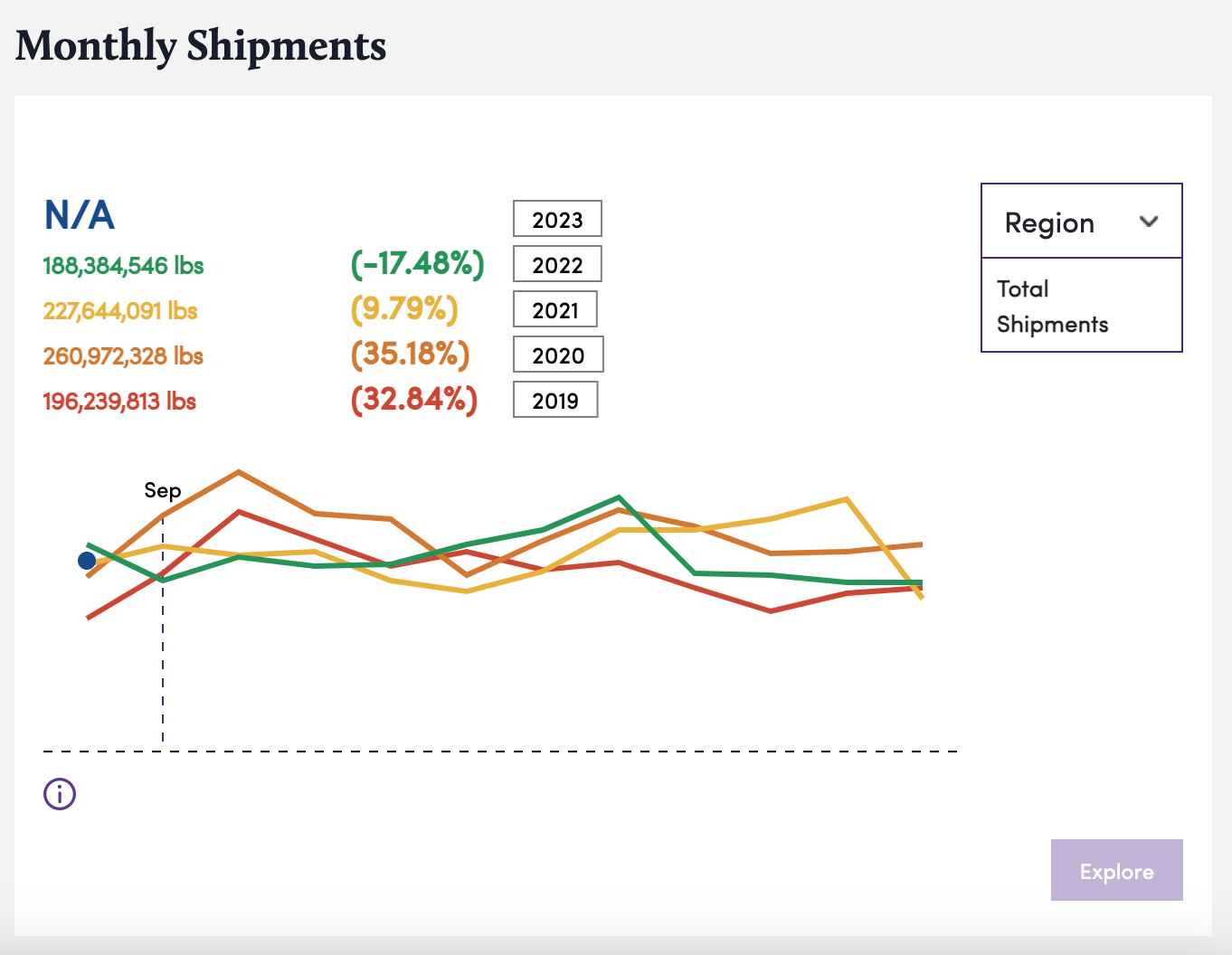

With crop receipts and shipments on everyone's mind before next week's September position report... Today I'll focus on crop receipts.

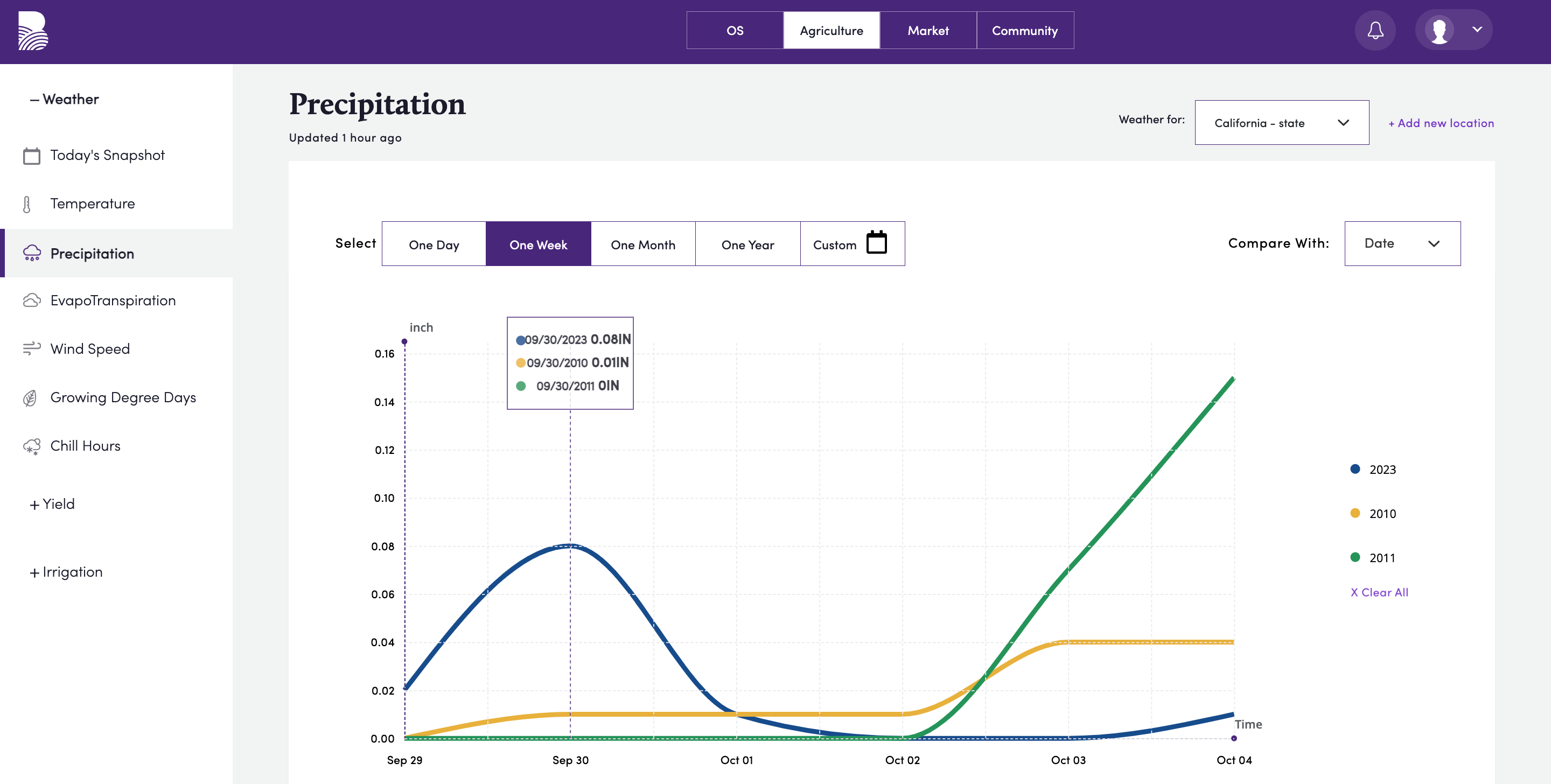

👇 You'll see a summary of Precipitation for California almond-growing regions over the last week comparing 2023, 2010, and 2011.

Following the release of the August position report, I highlighted the pattern of crop receipts, and what drives early receipts: Growing Degree Days and weather events like precipitation which can slow down processing. And we're expecting the rain from this weekend to most likely slow down crop receipts.

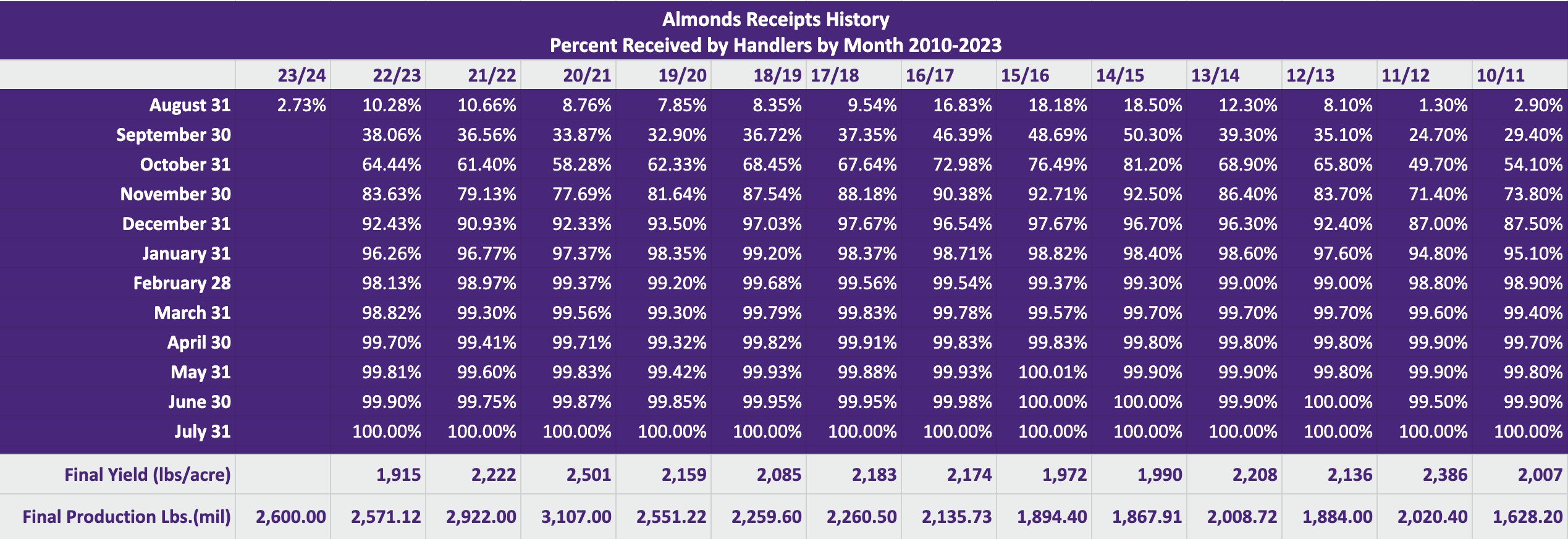

Sharing the Almond Receipts table 2010-2023 I included in your almond update following August's position report 👇.

👀 Looking ahead to the September Position report

Per the weather we've seen this harvest, we expect this year's receiving patterns to look similar to 2010 and 2011. Using the average for % crop receipts for September 2010-2011. September 2023 crop receipts should come in around 27.05% (703.3 M lbs) of the 2.6B lbs estimate.

While I wasn't in the almond industry during that time (10-11), I'd love to know how your receipts compare to those years. And if you have any data you'd like to share let me know.

Have a different opinion on crop receipts? Want to bet me on September receipts? Drop me note.

🎉 September Position Report Release

Almond Board of California will release the September 2023 position report next week, it's out on October 12th.

You can expect an email from Bountiful as soon as it's out, letting you know new data is added to Market for you!

Subscribe to Weekly Almond Update for the latest almond market intelligence and industry news.